It will be shown below that the Treasury has been using incorrect “predictions” to influence the debate on Independence. If the Conservatives are truly now a pro-Brexit party they must publicly rebut the Treasury Reports.

There have been two high profile sets of Treasury Predictions during the campaign for Independence from the EU. The first predictions were HM Treasury analysis: the immediate economic impact of leaving the EU, these were issued in May 2016 to affect the EU Referendum and the second set of predictions, issued in November 2018, were EU Exit: long term analysis and these have been used by MPs to prevent a WTO Brexit.

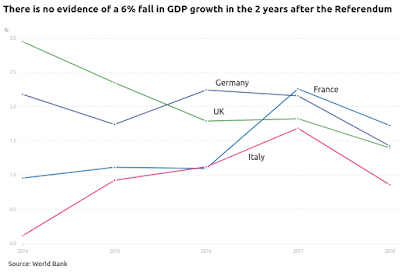

The 2016 predictions are widely accepted as being wrong by those who have studied them. They predicted that GDP would be 6% lower two years after the Referendum (a £120bn loss) and unemployment would rise by 500,000. When we compare UK GDP growth with the other leading EU economies it can be seen to be following a similar trend:

There is no real evidence that the Referendum affected GDP at all.

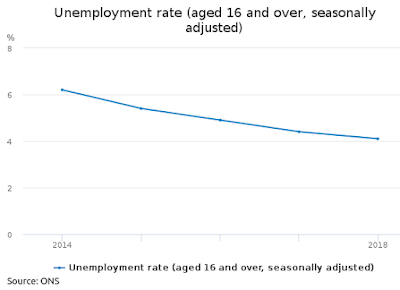

Unemployment fell steadily after the Referendum:

So the principle, headline grabbing predictions, were entirely wrong. The only prediction that was vaguely right was that the pound would fall over the 2 years but this was right for the wrong reasons, the pound is falling because of a long standing Current Account Deficit on the Balance of Payments (largely a deficit with the EU). The pound had been falling steadily since 2014:

The failure of the Treasury Predictions in 2016 has scarcely been covered by the Broadcast Media. This has allowed the population to trust the Treasury.

A Government that was truly seeking independence from the EU would have issued an apology for the 2016 predictions.

The 2016 prediction have rightly been called Project Fear. They were based on guesses at the effect of uncertainty on the UK economy after the Referendum and before the UK leaves the EU. Now we must call these predictions “Project Fear Mk1” because there have been an entirely different set of Treasury predictions, allegedly based on post brexit trade.

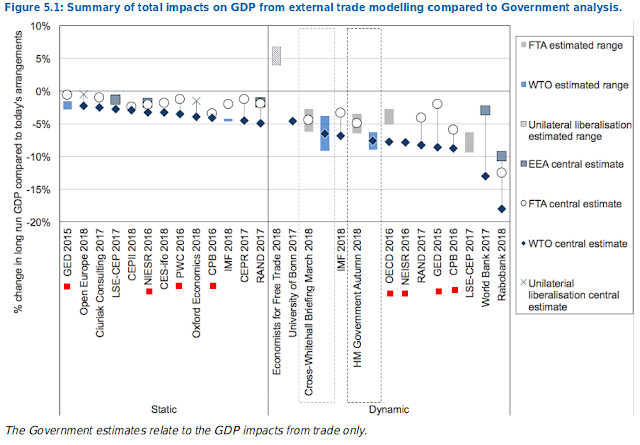

The punch line for these predictions is this graph (p81 of report):

The graph gives the impression that the Treasury figures are widely supported but those predictions marked with a red square were prepared to affect the Referendum in 2016 and are largely based on an imaginary collapse of the economy due to post-referendum uncertainty in 2016-2018. The inclusion of these largely discredited reports means that the Treasury predictions are not so widely supported. The discredited inclusions also show what the Treasury was trying to do: create Project Fear Mk2.

The “Long Term Analysis” is also widely known to be a fatuous exercise by economists. The analysis is for 12 years into the future. No economist can predict more than 18 months into the future with any reliability at all. The analysis is pure speculation. It is a political document.

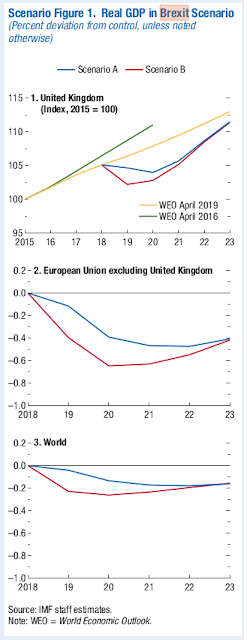

The IMF (which got 2016-2018 entirely wrong) has come up with a set of figures for Brexit in July 2019 that are at variance with the Government’s 2018 “Long Term Analysis”

(See IMF World Economic Outlook April and October)

In the case of a WTO Brexit the IMF has a Scenario A that has small scale imaginary effects and in scenario B large scale imaginary effects. No one actually knows how disrupted borders will be. The French reassure us that there will be no disruption on their side and the government now say disruption will be minimal on the UK side. However, the IMF are ignoring those who control the borders and are using an imaginary numbers for disruption.

The IMF graphs above are for April 2019. The IMF did not change its predictions in its October report despite the fall in UK GDP being imagined to be due to lack of preparation. Preparations for a WTO Brexit have been much stronger in the past 3 months and should have led to a re-appraisal of the IMF figures.

Once the assumption of reduced population growth is subtracted from the IMF figures they price leaving the EU at about £50bn – five years EU net contributions.

So Project Fear Mk2 comes in at about £50bn (IMF) to about £140bn (HM Gov). It is in the same range as and probably cheaper than Project Fear Mk1. The Referendum was fought as Project Fear Mk1 versus Independence and Independence won. Now MPs and the Remain media are howling about Project Fear Mk2 but we have already had a Referendum that approved the risk of a higher loss in the cause of independence. What is going on? It is simple: Remain forces will not let the UK Leave the EU.

If the Government truly supported Brexit they would apologise for Philip Hammond’s Treasury figures for No Deal. They would explain that half of his data points were discredited, they would apologise for mixing up population growth and economic growth, they would point out that no economist can predict more than 18 months into the future, they would tell us that the planning for leaving with No Deal had now reached a stage where the “disruptive” scenarios are history. Most importantly they should point out that the Treasury and IMF have an appalling record on Brexit that smacks of political interference and cannot be trusted to give unbiased predictions.

Having made this apology the Government should firmly state that MPs are not opposing No Deal, they are opposing Brexit. There is nothing to fear from No Deal and, even if there were, the risk was factored in to the Referendum which was Project Fear vs Independence and in 2016 Project Fear was more expensive than it is today. Otherwise nothing has changed.

This post was originally published by the author on his personal blog: http://pol-check.blogspot.com/2019/10/boris-johnson-must-publicly-reject.html

Daily Globe British Values, Global Perspective

Daily Globe British Values, Global Perspective