The Single Market is the economic basis of the EU, it allows the free movement of Capital, Labour and Trade within its members. It corresponds to what, in the UK, was called the “Common Market” until 1993. Countries can be full members of the Single Market by joining the EU or can be associate members by joining the European Economic Area (EEA). UK Membership of the EEA would involve a membership fee of about £4-5 billion a year and would mean that the UK stays in the “EU group” for World Trade Organisation (WTO) and IMF negotiations.

The EU group at the WTO represents its members who, although being listed as separate WTO members, do not use separate representation. The EU group concludes trade treaties on behalf of its members. The EU group is now dominated by the 19 Eurozone countries who have a single representative who sets EU group policies.

Given that the UK does not use the Euro and has a different trading profile from the Eurozone, do you want all UK trade deals to be controlled by the Eurozone?

The following article provides links throughout the text so that you can check it. The article is a series of links for you to check the data rather than a “blog”. If you find anything that is incorrect please comment below.

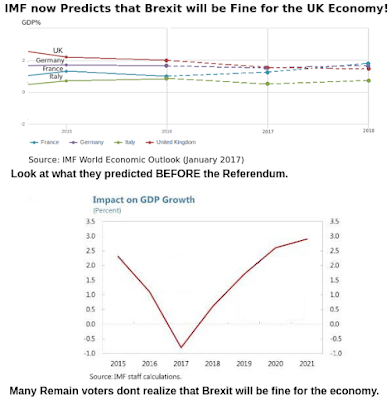

The dire IMF predictions for the UK economy have been withdrawn and the IMF has now revised its predictions. According to the experts Brexit will now be fine:

So why are many economists now happy about hard Brexit?

Does the UK currently benefit from being in the Common Market?

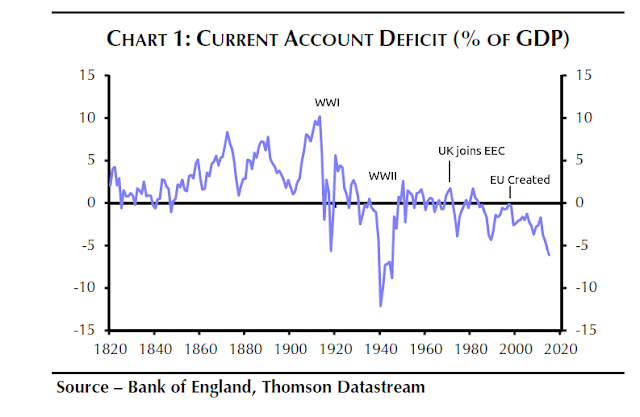

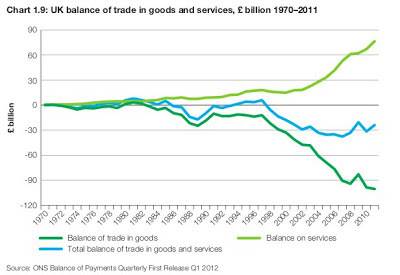

A nation’s “current account” measures the flow of actively produced wealth into or out of a country. Most economists consider that running a long term current account deficit is bad for a country’s economy. Some argue that short term deficits are fine but it is impossible to find any economist who will state that a long term current account deficit is better than a long term current account surplus. Even the USA, which controls the global reserve currency where overseas dollars partly work for the USA, is concerned when it’s current account deficit gets too high. The graph below shows the history of the UK Current Account:

| Don’t believe this? See Parliamentary Report for an official version |

“… a reduction in the current account deficit from its current record [peacetime] levels will be important for any government wishing to claim that the UK is making a balanced and sustainable economic recovery.” Parliamentary Report

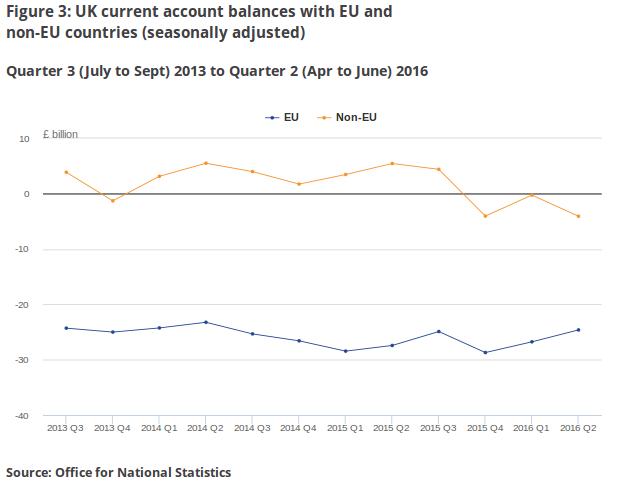

Much of the UK Current Account Deficit of over £100bn per annum is with the EU.

Don’t believe this? See ONS Balance of Payments

The current account deficit results from a trade deficit and also from the flow of capital (cash) out of the country as rents, profits etc. payable to overseas persons and companies. The Single Market allows the free movement of Capital and hence those transfers of cash out of the country. The free movement of Capital (money) is fine within the Eurozone where the European Central Bank now controls banking and the Eurozone financial committee now controls the national budgets.

The UK is not in the Eurozone and has independent control of its budget, this means that the UK has a different economic environment from Eurozone countries. The different economic environment has resulted in massive transfers of Eurozone investment into the UK because of the recent Eurozone crisis. Superficially this investment looks like a “good thing” but it has created huge long-term liabilities for payment of rents, profits and dividends to the EU (a “Primary Income Deficit”). The amount of this liability has been suppressed by the UK broadcast media.

The extent of the Primary Income problem. EU countries have invested over £4 TRILLION in the UK and receive annual payments of £30 bn. Add this to the £12bn of net payments to the EU for membership etc. and the result is direct cash transfers to the EU that total £42 bn per annum.

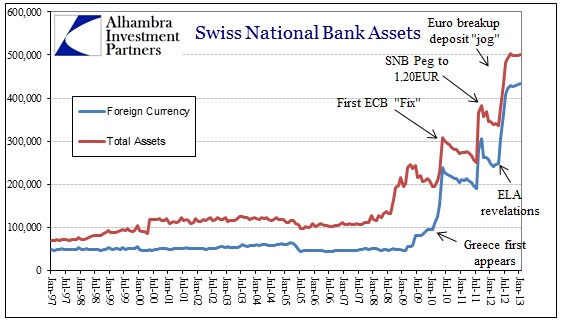

Unlike the UK, other countries that are outside of the Single Market can manage capital flows and so control the terms under which large investments are returned to investors, just 2% commission on currency exchange can have a marked effect. As an example, Switzerland has a huge Euro reserve maintained by its central bank to control investment.

Such a reserve is not permitted under Single Market rules.

You may support the unhindered movement of capital in the Single Market but it is as well to remember that much of foreign investment in UK industry is investment by foreign, state owned enterprises. The ownership of property is equally suspect According to the Financial Times:

“At least £122bn of property in England and Wales is held through companies in offshore tax havens …… Nearly two out of three of the 91,248 foreign-company owned properties in England and Wales are held via the British Virgin Islands and Channel Island structures.”

So the British are paying profits and dividends to Eurozone governments and rents to tax evaders. The wonders of foreign investment…

The Single Market also involves free trade with EEA/EU countries. Most Free Trade deals between countries contain some protection for strategic and important industries but the Single Market is simply Free Trade. There is no protection. Since the Maastricht Treaty created the EU in 1993 UK industry has been seriously imbalanced by Single Market membership:

Service industries have been favoured over manufacturing industries. It might be said that this is because UK manufacturers are too inefficient to compete but this is just a wanton slur on companies that perform extremely well outside the EU where, if anything, it is harder to compete:

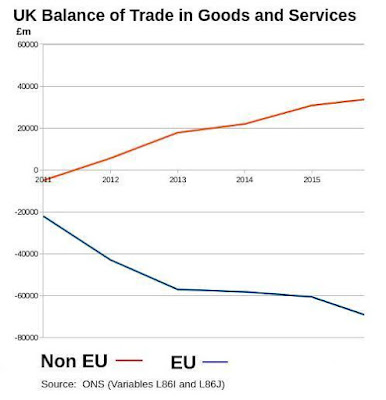

The trade deficit with the EU was £60.6 billion in 2015 and the trade surplus with the rest of the world was £29 billion (see Notes 4 and 5).

So what is happening? The big problem for the UK is that any industry operating here can buy parts and materials as easily from France, Italy or Germany as they can from the UK. This has a big effect on foreign owned manufacturers who are likely to buy their plant and materials from their German or French branches. If you are Nissan (Renault-Nissan) you will import your parts from your French central depot, if you are Lidl you will transport your food from your north German distribution centre and so on.

Service Sales

Much is made of the UK selling services to the EU. The UK sold £136 billion of services to the non-EU, rest of the world, in 2015 and had a £66 billion surplus on service sales. The UK only sold £89 billion of services to the EU at a surplus of £21 billion. Most important of all when considering the Single Market is that most service sales were NOT banking and insurance they were music, film services, professional services, digital services, software etc. : most service sales have no tariffs or barriers. However, it is always “the City”, the banks, that make the news.

The total contribution of banking financial services to global exports in 2015 was £50.7 billion – about 25% of total service sales – of which about £20 billion (40%) went to the EU. The insurance industry had £13 billion in exports of which about £3 billion (19%) went to the EU.

All of the talk about “passporting” UK bank and insurance transactions with the EU is an example of how the banks are manipulating the media and politicians. In fact passporting is easily overcome, for instance, many apparently “EU based” insurance companies and some banks are actually subsidiaries of US, Japanese, Australian etc. companies which, by operating subsidiaries, avoid passporting problems. Should the UK leave the single market British companies would use this method of overcoming “passporting” regulations. It should be stressed that many UK Banks and Insurance companies already have subsidiaries in the EU so the amount of Finance Industry exports that would be problematical is much less than £23 billion per annum. It is doubtful that more than £10bn of financial services exports will need to acquire “passporting”. It would be absurd to enter the Single Market just for the sake of passporting! (See The City needs the EU like a Fish needs a Bicycle for an in-depth discussion).

The WTO Option

The EU has very low tariffs on most of the goods that the UK exports. Most service exports have no tariffs at all. The big exceptions to this rule are cars and food. Cars attract a 10% tariff and food can have tariffs as high as 40%. The UK exports little food to the EU and cars are a special case (see below). A fairly full review of the WTO option can be found at: The WTO Option after Brexit. The top 20 Exports sold by the UK and the tariff percentages that are charged on these are given in Note 3 below.

The appalling trade deficit with the EU means that it is very much in the interests of the UK to delay any Free Trade Agreement with the EU until the trading and finance deficits are fixed. The EU has Free Trade Agreements with numerous countries which do not require membership fees or free movement of capital and labour. Prior to obtaining a Free Trade Agreement with the EU it will be possible to subsidise car and food exporters so that the tariffs do not affect them:

“Agreement that contracting parties imposing restrictions for balance-of-payments purposes should do so in the least trade-disruptive manner and should favour price-based measures, like import surcharges and import deposits, rather than quantitative restrictions. Agreement also on procedures for consultations by the GATT Balance-of-Payments Committee as well as for notification of BOP measures.” WTO.

There should be plenty of money for refunds because the EU will be paying £12.9bn pa in tariffs against the UK’s £5.2bn.

Of course, most people who voted in the EU Referendum thought they were voting to leave the Common Market. It is amazing how the broadcast media can twist the meaning of words.

Supplementary Information

See ONS Statistical Bulletin Tables for the raw data on which this part of the article is based,

Note 1: Economist’s views of the Current Account Deficit. It is difficult to find any economist who finds that a Current Account Deficit is better than a Current Account Surplus.

” A persistent current account deficit could lead to a sudden adjustment in capital flows or depreciation of the exchange rate, with adverse consequences for UK financial stability.” Bank of England

Which is, of course, precisely what has happened:

There are large numbers of economists who take the view that a Current Account Deficit benefits someone somewhere in the world so cannot be all bad:

” In fact, trading with foreigners is no different than trading with locals and is always just as beneficial from an aggregate economic point of view.” Investopedia: Is a current account deficit good or bad for the economy?

They miss the point that the foreign beneficiary is often a corrupt Central Asian dictatorship or National Socialist China etc. who are benefiting when there are people using food banks in the UK! Indeed, the moment we hear the term “aggregate economic benefit” we should understand that the imagined benefit is for multinational corporations and mobile international economists. Indeed, the EU Referendum was really about a revolution against these smug “aggregate benefit” ideas.

Note 2: The “Rotterdam effect” has little effect on the overall deficit with the EU.

Note 3: Exports and tariffs

UK Exports – top 20.

Note 4: Trade deficit with EU revised to £60.6bn in latest release of tables from £68bn.

Note 5: Trade figures for 2015

Exports to EU: Goods £133bn Services: £96bn Total £230bn

Imports from EU: Goods £184bn Services: £72bn Total £256bn

Exports to non-EU: Goods £153bn Services: £133bn Total: £287bn

Imports from non-EU: Goods £184bn Services: £72bn Total £256bn

Source: https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/datasets/balanceofpaymentsstatisticalbulletintables

This post was originally published by the author on his personal blog: http://pol-check.blogspot.co.uk/2016/12/the-eu-single-market-good-or-bad-for-uk.html

Daily Globe British Values, Global Perspective

Daily Globe British Values, Global Perspective

Magnificent John, thank you. Have sent it to David Davis with the comment that Hammond could do with reading it if his comments about the Customs union say anything about his knowledge of EU economics.