A home is somewhere for a family to live, so it should be affordable within the wages that most people earn. This is obviously not true in the UK today. We have a massive house price bubble, which is utterly ridiculous when you consider that a four bedroom family house built by a mass production builder on an estate costs only about £100,000 to build. And the value of the agricultural land (between £5K and £10K an acre) that these homes could be built on is only a couple of thousand pounds for a huge garden. A two bedroom apartment can easily be built for £50,000. If you paid more than these prices you were robbed by the system.

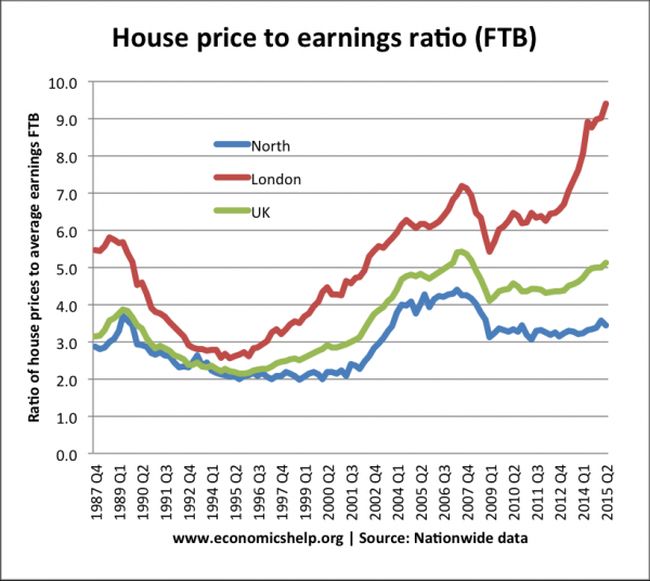

The Blair/Brown government lasted from May 1997 until May 2010. As you can see in the graph above they totally lost control of the housing market. House price inflation rocketed. Gordon Brown’s massive 7% recession in 2008 dented the market slightly, but the bubble remained inflated. This is just one of many instances of harm that Labour governments have inflicted on the British people. The fact that zero council houses were built in this time just poured petrol on the fire by further restricting supply.

Now we have the graph of how affordable homes are. How many years of average income it would take to buy a house. Margaret Thatcher was Prime Minister from May 1979 till November 1990 and you can see how her policies (“property owning democracy”) made homes affordable for all, costing between two and three years’ income. Now we have a bubble where homes cost five times average income and in London a ridiculous nine times average income. Housing is the greatest cost a family has and the bubble has increased the cost to the point of unaffordability. People are suffering genuine hardship. And it is your governments that have done this to you. In a genuine free market homes would be half the cost or less.

So just what has gone wrong?:

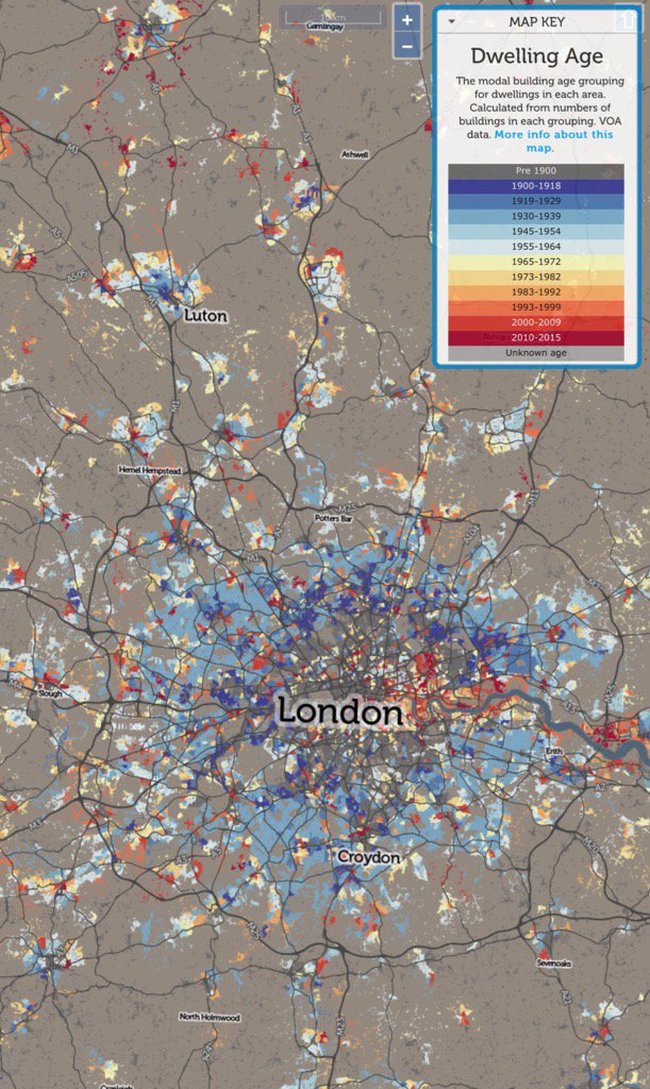

- A planning system that is designed to minimise new builds. Yet our country is largely undeveloped. The UK National Ecosystem Assessment (NEA) says that 10.6% of England, 1.9% of Scotland, 3.6% of Northern Ireland and 4.1% of Wales is urbanised. But in England, for instance, 78.6% of urban areas is designated as natural rather than built. So just 2.27% of English landscape is built on! This is easily confirmed by spending a few minutes on Google Earth.

- The Green Belt. This, at more than one and a half million hectares, is many times bigger than the amount of built on land in towns and cities that humans live in. It strangles the natural growth of our communities. And all that it gives us is industrialised rape fields instead of suburban gardens. Green belt policy alone is reckoned to have increased the cost of building land from 25% of total home price in the late 1950s to well over 70% today. It must go. With national parks, areas of outstanding natural beauty and the National Trust protecting the great British countryside there is no need for green belt.

- Ultra low interest rates. It costs nearly nothing to borrow money, which makes mortgages cheap. This vastly increases demand, pushing prices up when there is no corresponding increase in supply.

- Quantitative easing. When Gordon Brown had effectively reduced interest rates to zero and the economy was still contracting he started printing vast amounts of money. The idea was that this would stimulate economic activity, such as manufacturing. Instead the cash mountains sloshing around have fueled a number of asset bubbles. Old cars, fine art, good wine and, of course, housing.

- Foreign rich people. Billionaires and multi millionaires in Russia, China, Greece and the Middle East see the UK as a very safe place to park big lumps of their cash, often black money gained from corruption. They pay little tax here, the value of their property here has rocketed and they can even stay in it for a week or two each year. This huge demand has a knock on impact right down the market. The good news for us is that the collapse of the oil price and the crack down on Chinese corruption caused top end London apartment values to drop by 20% last year.

- NIMBYs. These disgusting, execrable people think that nobody else should live in nice homes, in nice places so they put massive effort into harming other members of society. They occupy the very lowest moral ground. Their main organisation is the Campaign to Protect Rural England (CPRE) who seem to think that the proletariat should live in rabbit hutches.

- George Osborne’s Help to Buy and other such schemes are economically illiterate, they increase demand when there is no corresponding increase in supply, pouring yet more fuel onto house price inflation. Whilst wasting taxpayer’s money.

- Buy to let. The explosion in this has been fueled by government policy. Basically it is vastly easier for a landlord to borrow to buy your home than it is for you to do so. Not only that, it is vastly more tax efficient for the landlord to own your home. George Osborne had started to reverse this but it is too little, too late.

- Estate Agents. Their main economic purpose is to increase house prices. They really are the enemy of the market and of the house buyer.

- Highly inefficient housing market. It takes years between buying a plot of land and having a home to move into. In the past this has been done in months. Even deciding to buy an already existing house leads to huge, needless delays before moving in. This sclerotic market forces prices ever upwards and gives yet more advantage to landlords over owner occupiers. The Government’s Competition and Markets Authority desperately need to sort this disaster area out.

- Massively increased population, increasing demand. EU citizens come here to apply their skills by working in our booming economy. Vast numbers of third world economic migrants were brought in by the Labour government and are now bringing in their dependents, their arranged marriage spouses and then their dependents. EU citizens will tend to often come and go dependent on economic demand. Third world economic migrants are here for ever.

As you can see there are many causes of the dreadful problem that we have. And there is only one real answer, which is to vastly increase supply. In the 1960s we built more than 400,000 new homes a year, by 2012/13 we had the lowest year for official UK housebuilding since the 1920s with just 135,117 new homes. In September last year Brandon Lewis, the housing minister, set out a target to build one million new homes before the end of the current Parliament. So a little more than 200,00 a year. This is utterly pathetic. To meet pent up demand and to replace low grade housing stock we must build at least three times that.

We need to go to a system where planning permission is automatic and issued almost immediately, unless there are exceptional reasons not to. This sort of free for all is what created most of the homes in Britain today. Green belt must go, it causes vast harm. Farm land must become building land, as it always has done in the past and as it does in so many other countries. We have got more than enough.

Even such a huge house building programme would only correct prices slowly because of inevitable time scales. So we would not get a massive negative equity problem. Interest rate rises are far more likely to create that.

This post was originally published by the author 2 February 2016: http://www.bruceonpolitics.com/2016/02/02/why-do-we-have-a-house-price-bubble/

Daily Globe British Values, Global Perspective

Daily Globe British Values, Global Perspective